Getting out of debt is a difficult hurdle for anyone– especially those with low income.

There is no shortage of experts or advice on this topic. If you spend a few minutes on Google you’ll be able to find articles encouraging you to “spend less” and “save more”, as if those concepts had never occurred to you. Sometimes your circumstances aren’t in your control, and it isn’t always as easy as cutting back on luxuries and getting a second job.

If you’ve made it here, I’m going to assume you’re not looking for generic advice. As someone who was formerly in debt while making less than half of the U.S. median household income, I know firsthand that packing my own lunch, and brewing my own coffee at home were important first steps for digging my way out of debt—but it really didn't feel like it was moving the needle.

If you’re going to claw your way out of debt, you need more than conventional wisdom and catchphrases. You need a full-scale battle plan.

Budgeting 101

Putting a budget together isn’t exactly rocket-surgery, but it’s something I had to teach myself. There's a lot of people out there who don't have a budget, simply because no one ever showed them how to make one, what it looks like, or what they should be tracking. If you're one of those people, this blog is for you.

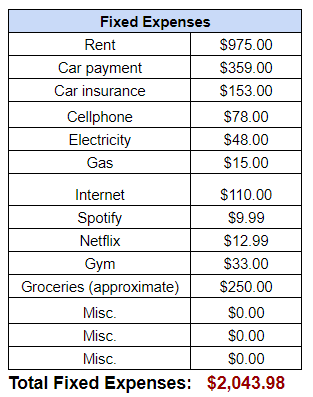

My budget template isn’t fancy, but it’s effective. Here’s how I put it together:

Step 1

You’ll want to record any monthly recurring financial obligations like rent, mortgage, insurance, etc. Don’t forget to also include the smaller stuff like gym memberships, cable bills, streaming services and apps. Do your best to estimate what you're spending on gas and groceries. Add all this up:

Step 2

Then add up all of your income sources.

Step 3

Subtract your total income from your total fixed expenses.

Once you’ve subtracted your total income from your total fixed expenses, you’ll have a rough idea of how much you have leftover each month to put toward your debt and any other incidental expenses you might have.

Now that you have a clear picture of your monthly expenses, can you identify anything that you can live without? I’m not suggesting cutting everything that you enjoy. In fact, I’m suggesting the opposite. I wholeheartedly believe that my gym membership is a necessity for my mental and physical health, and in the long run saves me money on medical bills.

I also think that by spending a few bucks a month for the entertainment that Netflix provides, I’m less likely to go out and spend money at a restaurant or nightclub. You don’t necessarily have to scale back to a bare bones budget, but you should definitely be honest with yourself and know the difference between what you want and what you need.

Determine your total amount of debt

Determining exactly how much you owe is a crucial first step to getting out of debt with low income. It might be intimidating to sit down and have to face the reality of the situation, but you need the exact figure in order to create a realistic plan to get control of your finances. Set aside a specific time where you’ll be free of distractions and collect all of your outstanding bills and statements.

List the name of each organization you owe money to and next to that, write down the amount you owe them.

The snowball method

Our method for getting out of debt with low income is to identify the creditor that you owe the least to, and tackle that debt first. Put as much of your income as you can toward the smallest debt, while also continuing to make the minimum payments on your other debts. This strategy is commonly known as Dave Ramsey’s snowball method.

In the budget example above, you can see that after all monthly expenses are paid, this person has $640.02 left after their fixed expenses have been taken care of. You can also see that if that entire amount was applied toward this person’s Visa bill, that they would have that debt paid off in full after just two months!

Granted, it’s unlikely that you’ll be able to apply your entire leftover income toward debt, but hopefully as you begin to crunch these numbers you’ll see that while the obstacles in front of you are challenging, they are not impossible to overcome if you continue to diligently chip away at them.

Part of the idea behind the snowball method is that as you continue to make payments and knock out your debts, you’ll continue to build confidence and follow through with your plan. It’s very common for people who are in deep debt to either be in denial, or just simply give up on trying to repay because the amount seems insurmountable.

Consider extra income options

For some people, getting a second gig just isn’t in the cards. Maybe you already work multiple jobs, or you can’t find childcare, or you’re still in school.

If you do have the time to devote to making a few extra bucks, there’s more options to choose from than you might realize. A part-time job as a barista or driving for Uber is what comes to mind for a lot of people when they think about extra income, but there are a variety of options that don’t even require leaving the house.

Think about what skills you have that might be valuable to other people, and then brainstorm where to find people looking for that skill set. Websites like Fiverr, UpWork, and Freelancer are great for picking up side jobs for all skill levels and flexible hours. Starting with a $5 flat fee for data entry projects, all the way up to $150 an hour for event photography.

Our friends at Think Save Retire created this expert’s guide to side hustling that provides an in-depth look at all of the different ways you can be making extra cash to pay down your debt and achieving financial freedom.

Look into debt consolidation

If you have multiple creditors, and your total debt does not exceed half your income, consolidation might be the right option for you. Put simply, debt consolidation is a personal loan that allows you to roll all of your credit card bills and high-interest loans, into one consolidated amount that has a lower interest rate.

It might seem counterintuitive to get another loan when you’re trying to dig your way out of debt, but debt consolidation can provide real hope since you’ll be paying a lower interest rate on one lump sum, instead of accruing interest charges at a high rate on multiple accounts.

Make sure to carefully screen your debt consolidation company and do your due diligence online before entering into a written agreement.

If you have more questions, check out our in-depth guide on debt consolidation.

Credit Counseling Services

If none of the above strategies worked out, credit counseling services are the next logical step. Most credit counseling services are non-profit agencies that assist consumers who need help managing their financial burden.

Depending on your particular situation, your credit counselor might suggest a debt management plan, which would allow them to contact your creditors on your behalf in order to negotiate new terms that will allow you to pay back your balance sooner. Once the new terms are set, your counselor would then set up a payment plan based on your financial situation, and you would make payments directly to the counseling service, which they would then use to pay your creditors.

As always, do extensive research on any financial service you’re planning on doing business with, especially if they are charging for their services. A lot of credit counselors are non-profit, so try to seek those out if possible.

Debt Forgiveness

This one is definitely not as easy or effective as it sounds.

Debt relief or debt forgiveness, consists of a third party negotiating on your behalf with your creditors to attempt to persuade them to lower the total amount of money owed. However, this should be a last resort, as it can negatively impact your credit rating.

There are also some risks involved with debt forgiveness of which you should be aware. Both the Federal Trade Commission and the CFPB warn consumers to proceed with caution before allowing a company to negotiate your debt, as they may charge inflated fees or take additional payments for themselves..

Bankruptcy

If you are in a situation where you know you cannot reasonably hope to pay off your debt even if you implement the suggestions mentioned above, you may need to consider declaring bankruptcy.

Chapter 7 bankruptcy and Chapter 13 bankruptcy are your two primary options. With the former, your assets are sold and the money is distributed to your creditors, and any leftover debt is discharged. With the latter, you are given a plan to repay part or all of your debt, but keep your assets in the process. If you are seriously considering one of these options, make sure you speak to a knowledgeable personal bankruptcy attorney who is familiar with your state’s bankruptcy laws.

If you’ve exhausted all your resources and it’s time to throw in the towel– don’t feel bad. There are plenty of people who have bounced back from bankruptcy.

It’s one thing to get out of debt

Once you’ve figured out your strategy for getting out of debt, it’s important to figure out a way to stay out. Debt can be a vicious cycle, but taking control of your finances now and avoiding the pitfalls that got you into debt in the first place are the best ways to prevent a similar situation in the future.

How is your battle with debt going? Do you have more questions? Let us know in the comments!